The Problem

Social Security fails because it's built on forced sacrifice, violates individual rights, and is economically unsustainable by design.

Mitchell, Daniel J. (2025). Social Security’s $65.8 Trillion Problem.

Retrieved from https://danieljmitchell.wordpress.com

Social Security is failing because it was built on flawed economic assumptions. It is not a retirement savings system but a pay-as-you-go transfer program, in which current workers’ taxes are used to pay current retirees. Such a structure can function only while the number of workers grows faster than the number of beneficiaries. That condition no longer exists—and cannot be reversed.

From the outset, Social Security made no provision for real saving or investment. Contributions are not set aside, do not compound, and create no owned assets. Benefits depend entirely on current taxpayers. Any unused “contributions” vanish at death and cannot be passed on to heirs. This design leaves the system vulnerable to demographic change, political pressure, and economic slowdown. The result is structural insolvency.

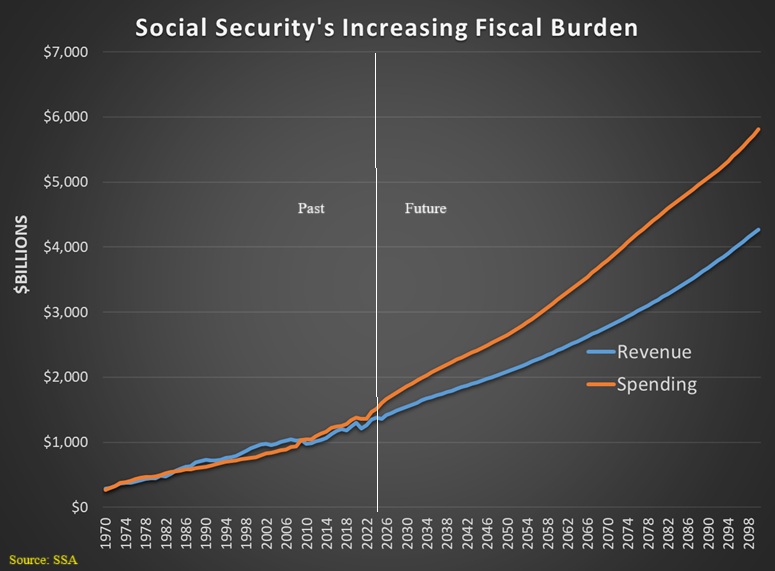

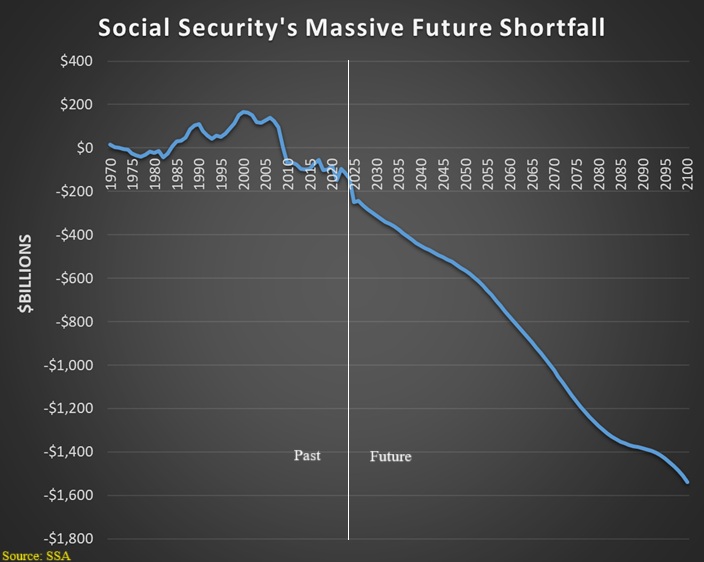

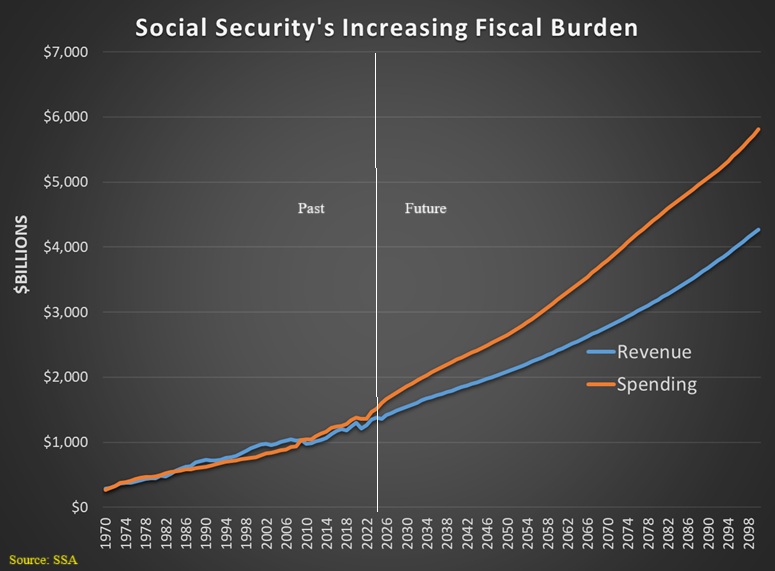

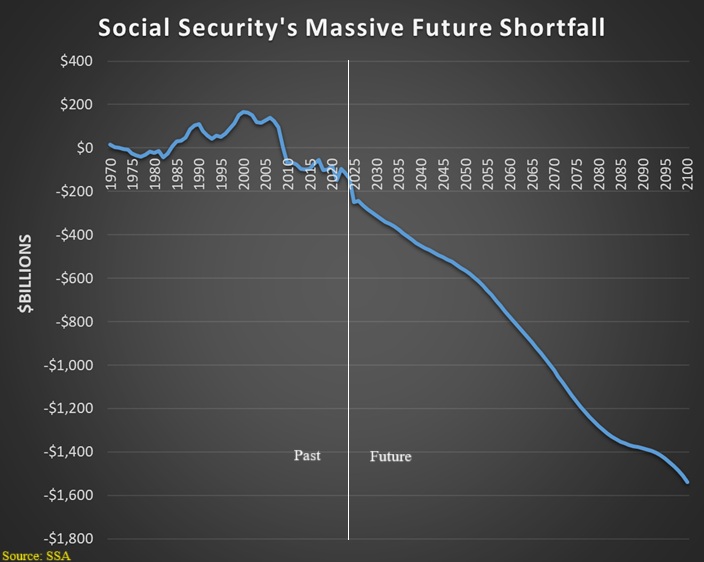

The consequences are now unavoidable. According to the Trustees, the trust funds will be depleted by 2033. Under current law, benefits must then be cut by roughly 23 percent, with larger shortfalls in later decades. Fewer workers per retiree, longer life expectancy, and slower labor-force growth ensure that the imbalance will worsen over time.

Even before insolvency, Social Security has been a poor deal for nearly all workers. The core problem is not merely low returns, but the loss of compounding. Payroll taxes that could have been saved and invested instead pass through the system immediately, leaving no accumulated capital. Over a full working lifetime, even conservative saving and investment would have produced retirement assets several times larger than what Social Security promises—but cannot pay. Unlike real savings, Social Security provides no inheritable wealth; workers who die early receive little or nothing, regardless of lifetime contributions.

The economic impact extends beyond individual retirees. For nearly a century, trillions of dollars that could have become private savings, capital investment, business formation, and productivity growth were instead routed through a system that creates no assets. Those foregone savings represent lost economic growth, lower wages, and reduced opportunity. The cumulative cost to the economy is enormous.

In short, Social Security faces multiple, reinforcing problems:

• It relies on an unfunded pay-as-you-go structure

• It cannot withstand demographic reality

• It delivers poor outcomes relative to achievable alternatives

• It creates no inheritable retirement assets

• It suppresses saving and long-term economic growth

• It is approaching automatic benefit cuts under current law

These problems are inherent in the system’s design. Incremental adjustments may delay the consequences, but they cannot resolve the underlying weaknesses.

There is, however, a different approach—one based on real saving, real ownership, inheritability, and long-term solvency. See The Solution.

CALL TO ACTION

America will only secure real retirement freedom if millions of citizens demand it. Sign up to help push Congress toward action—and make this change a national priority.

© Copyright 2025. PRAUSA. All Rights Reserved. Content may not be reproduced without permission.

The Problem

Social Security fails because it's built on forced sacrifice, violates individual rights, and is economically unsustainable by design.

Mitchell, Daniel J. (2025). Social Security’s $65.8 Trillion Problem. Retrieved from

Social Security is failing because it was built on flawed economic assumptions. It is not a retirement savings system but a pay-as-you-go transfer program, in which current workers’ taxes are used to pay current retirees. Such a structure can function only while the number of workers grows faster than the number of beneficiaries. That condition no longer exists—and cannot be reversed.

From the outset, Social Security made no provision for real saving or investment. Contributions are not set aside, do not compound, and create no owned assets. Benefits depend entirely on current taxpayers. Any unused “contributions” vanish at death and cannot be passed on to heirs. This design leaves the system vulnerable to demographic change, political pressure, and economic slowdown. The result is structural insolvency.

The consequences are now unavoidable. According to the Trustees, the trust funds will be depleted by 2033. Under current law, benefits must then be cut by roughly 23 percent, with larger shortfalls in later decades. Fewer workers per retiree, longer life expectancy, and slower labor-force growth ensure that the imbalance will worsen over time.

Even before insolvency, Social Security has been a poor deal for nearly all workers. The core problem is not merely low returns, but the loss of compounding. Payroll taxes that could have been saved and invested instead pass through the system immediately, leaving no accumulated capital. Over a full working lifetime, even conservative saving and investment would have produced retirement assets several times larger than what Social Security promises—but cannot pay. Unlike real savings, Social Security provides no inheritable wealth; workers who die early receive little or nothing, regardless of lifetime contributions.

The economic impact extends beyond individual retirees. For nearly a century, trillions of dollars that could have become private savings, capital investment, business formation, and productivity growth were instead routed through a system that creates no assets. Those foregone savings represent lost economic growth, lower wages, and reduced opportunity. The cumulative cost to the economy is enormous.

In short, Social Security faces multiple, reinforcing problems:

• It relies on an unfunded pay-as-you-go structure

• It cannot withstand demographic reality

• It delivers poor outcomes relative to achievable alternatives

• It creates no inheritable retirement assets

• It suppresses saving and long-term economic growth

• It is approaching automatic benefit cuts under current law

These problems are inherent in the system’s design. Incremental adjustments may delay the consequences, but they cannot resolve the underlying weaknesses.

There is, however, a different approach—one based on real saving, real ownership, inheritability, and long-term solvency. See The Solution.

CALL TO ACTION

America will only secure real retirement freedom if millions of citizens demand it. Sign up to help push Congress toward action—and make this change a national priority.

© Copyright 2025, PRAUSA. All Rights Reserved. Content may not be reproduced without permission.