The Plan

The PRA Plan replaces Social Security with individually owned, inheritable accounts that grow with wages. Workers under 55 receive retroactive credits and build PRA balances that yield higher benefits and greater flexibility than today’s system. As legacy retirees decline, FICA gradually converts into lower mandatory PRA contributions, ultimately creating a fully private, property-based retirement system with rising take-home pay.

Personal Retirement Accounts

Transitioning Social Security to Solvency

Purpose and Design Principle

This Plan replaces the Old-Age and Survivors Insurance (OASI) component of Social Security with a fully specified system of Personal Retirement Accounts (PRAs). The objective is a retirement system that is solvent, transparent, and based on individual ownership. Every feature corresponds directly to defined technical parameters so the system can be independently scored and evaluated.

Scope of the Reform

The Plan applies only to OASI. Disability Insurance, Medicare, and other federal programs remain unchanged. Workers age 55 and older at implementation remain permanently in the legacy Social Security system. Workers under age 55 transition to PRAs and cease accruing additional legacy Social Security benefits. The Plan resolves the projected OASI shortfall by closing the legacy system to new accruals, stabilizing obligations through defined eligibility and formula parameters, and allowing pay-as-you-go outlays to contract naturally as PRA participation expands.

Eligibility and Transition

At implementation (assumed January 1, 2028 for scoring), all workers under age 55 enter the PRA system. Workers 55 and older remain in Social Security for life. For each transitioning worker, past FICA-covered earnings are translated into PRA credits using the same 35-year, wage-indexed framework used under current law. Spouses hold separate PRAs, preserving individual property rights and simplifying inheritance.

How PRA Credits Are Calculated

PRA credits use the familiar Social Security benefit-formula structure applied to a worker’s highest 35 years of AWI-indexed earnings. Replacement rates for PRA participants are increased by 10 percent relative to current law. Credits grow annually at the Average Wage Index. During the transition, balances are notional, wage-indexed property claims recorded by SSA, eliminating market risk while aligning obligations with national wage growth.

Retirement Age and Timing

The statutory retirement age is 68. Early retirement is permitted with actuarially appropriate reductions; delayed retirement increases benefits through continued AWI growth. Retirement is voluntary, and continued work always increases the PRA balance.

Conversion to Custodial Accounts

At retirement—early, at age 68, or later—a worker’s notional PRA converts in full to a private custodial PRA account, becoming real financial property held outside the government bookkeeping system.

Retirement Payout Options

After conversion, retirees may choose systematic withdrawals, partial annuitization, or full annuitization. Annuitization is not mandatory. Minimum-income rules may be applied analytically for scoring. Unannuitized balances remain fully inheritable; annuitized residuals follow the rules specified in the Technical Specifications.

Ownership and Inheritance

PRA balances are owned property. If a worker dies before or during retirement, any unannuitized balance passes to the estate. Nothing is forfeited.

Tax Treatment

During the notional phase, PRA credits are treated as deferred retirement entitlements. Upon conversion, custodial PRAs follow IRA-style tax treatment: contributions and earnings are tax-deferred and withdrawals are taxable under standard retirement rules, consistent with conservative scoring.

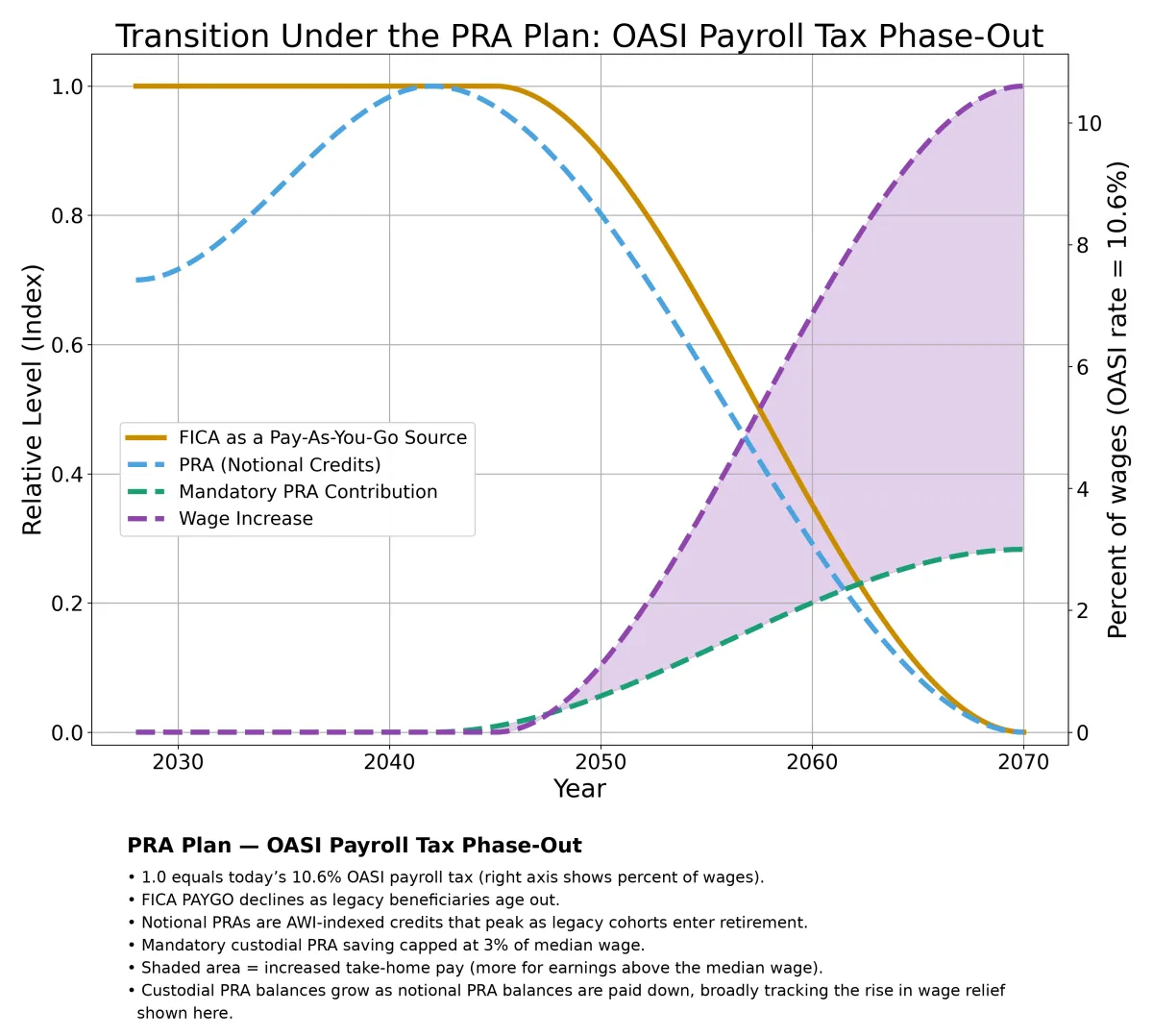

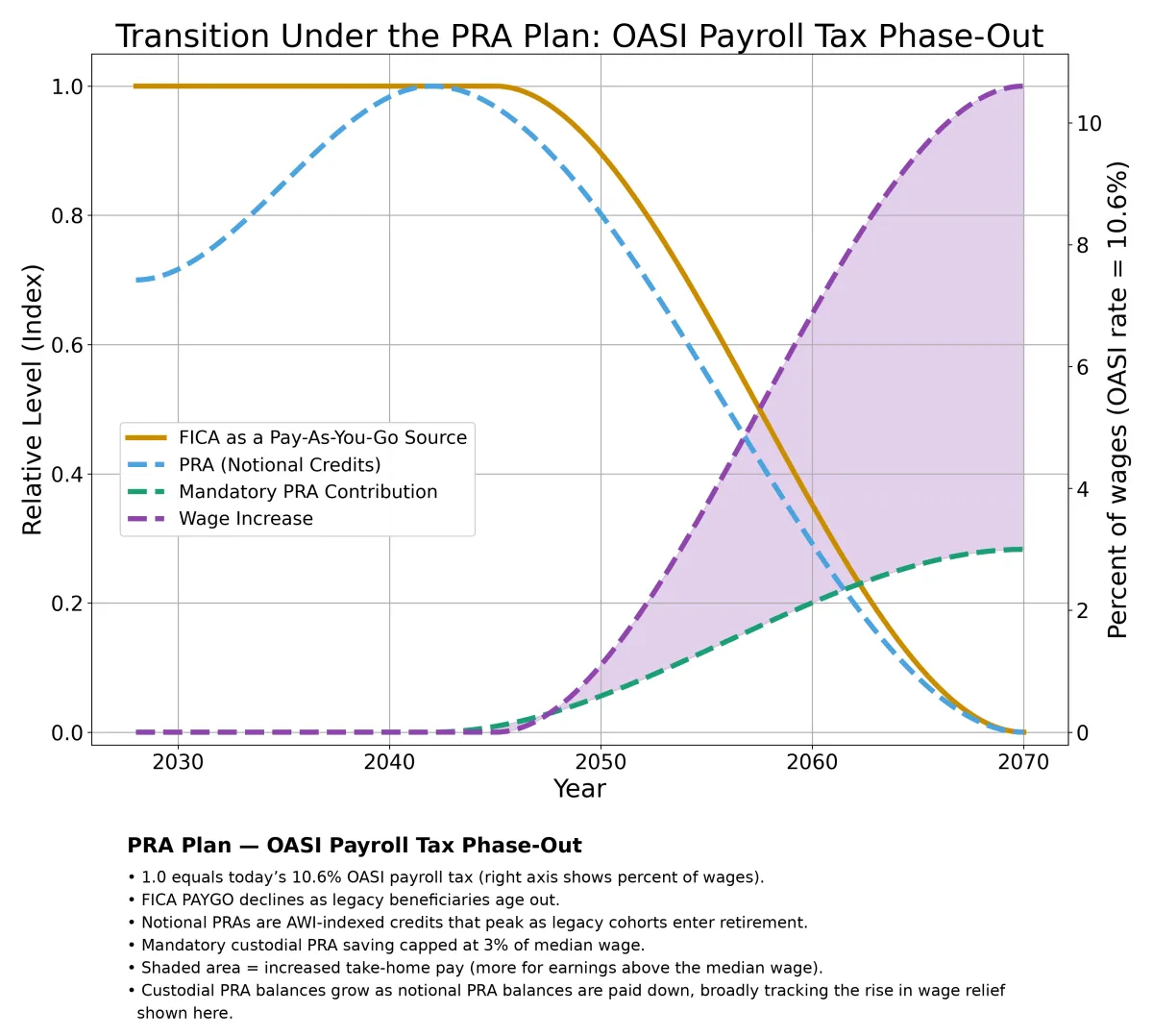

How FICA Evolves

FICA remains unchanged initially to fund legacy obligations. Workers under age 55 continue to pay FICA during the transition, but those payments finance only legacy beneficiaries and generate no additional legacy accruals. As legacy outlays decline, remaining FICA collections are reclassified as PRA contributions.

When approximately 95 percent of remaining beneficiaries are PRA retirees and the legacy system has contracted to a small, predictable residual, the reduced FICA stream is redirected into private custodial PRAs. The payroll mechanism remains unchanged; only the destination changes. The default mandatory PRA contribution is about 3 percent of earnings, capped at median wages. Workers may voluntarily contribute more, and employers may offer matching contributions.

End State

As PRA contributions replace FICA, required saving is far lower than today’s payroll tax, raising take-home pay—especially for earnings above the median, which are no longer subject to a replacement tax. Because custodial PRAs earn full market returns, retirement benefits are projected to be much more than what Social Security is obligated to pay. As legacy beneficiaries pass away and PRA retirees complete their payout periods, government retirement obligations disappear. The pay-as-you-go system ends by being fully and permanently replaced by owned retirement property.

All technical assumptions, scoring parameters, and transition rules are governed by the Technical Specifications for Scoring.

Chart: © 2025 PRAUSA

Summary of What the PRA Plan Achieves

• Replaces the OASI portion of Social Security with individually owned Personal Retirement Accounts

• Automatic enrollment for all workers under age 55

• Full protection for current retirees and near-retirees

• Closure of the legacy system to new benefit accruals

• Resolution of the projected OASI shortfall through orderly contraction

• PRA credits based on the familiar 35-year, wage-indexed framework

• Replacement rates increased by 10 percent relative to current law

• AWI indexing for long-run solvency and wage alignment

• Statutory retirement age of 68 with flexible early or delayed retirement

• Full conversion of notional PRAs to private custodial accounts at retirement

• Multiple payout options after conversion, including withdrawals and annuitization

• Fully inheritable retirement property with no forfeiture at death

• IRA-style tax treatment for custodial PRAs, consistent with conservative scoring

• Gradual transition from payroll taxes to private saving through FICA redirection

• Default mandatory PRA contribution of about 3 percent of earnings

• Mandatory contributions capped at median wages, not today’s $184,500 OASI cap

• Workers earning above the median face no replacement tax as FICA phases out

• Effective wage increase of 10.6 percent on earnings above the median

• Projected retirement wealth several times greater than Social Security is obligated to pay

• Rising take-home pay, stronger work incentives, and higher national saving

• A permanent shift from intergenerational transfers to funded, owned retirement assets

Social Security was built for a world that no longer exists. The PRA Plan replaces it in an orderly, transparent way that protects older Americans, empowers workers, strengthens families through inheritance, and restores long-run retirement solvency through ownership.

CALL TO ACTION

America will only secure real retirement freedom if millions of citizens demand it. Sign up to help push Congress toward action—and make this change a national priority.

© Copyright 2025. PRAUSA. All Rights Reserved. Content may not be reproduced without permission.

The Plan

The PRA Plan replaces Social Security with individually owned, inheritable accounts that grow with wages. Workers under 55 receive retroactive credits and build PRA balances that yield higher benefits and greater flexibility than today’s system. As legacy retirees decline, FICA gradually converts into lower mandatory PRA contributions, ultimately creating a fully private, property-based retirement system with rising take-home pay.

Transitioning Social Security to Solvency

Purpose and Design Principle

This Plan replaces the Old-Age and Survivors Insurance (OASI) component of Social Security with a fully specified system of Personal Retirement Accounts (PRAs). The objective is a retirement system that is solvent, transparent, and based on individual ownership. Every feature corresponds directly to defined technical parameters so the system can be independently scored and evaluated.

Scope of the Reform

The Plan applies only to OASI. Disability Insurance, Medicare, and other federal programs remain unchanged. Workers age 55 and older at implementation remain permanently in the legacy Social Security system. Workers under age 55 transition to PRAs and cease accruing additional legacy Social Security benefits. The Plan resolves the projected OASI shortfall by closing the legacy system to new accruals, stabilizing obligations through defined eligibility and formula parameters, and allowing pay-as-you-go outlays to contract naturally as PRA participation expands.

Eligibility and Transition

At implementation (assumed January 1, 2028 for scoring), all workers under age 55 enter the PRA system. Workers 55 and older remain in Social Security for life. For each transitioning worker, past FICA-covered earnings are translated into PRA credits using the same 35-year, wage-indexed framework used under current law. Spouses hold separate PRAs, preserving individual property rights and simplifying inheritance.

How PRA Credits Are Calculated

PRA credits use the familiar Social Security benefit-formula structure applied to a worker’s highest 35 years of AWI-indexed earnings. Replacement rates for PRA participants are increased by 10 percent relative to current law. Credits grow annually at the Average Wage Index. During the transition, balances are notional, wage-indexed property claims recorded by SSA, eliminating market risk while aligning obligations with national wage growth.

Retirement Age and Timing

The statutory retirement age is 68. Early retirement is permitted with actuarially appropriate reductions; delayed retirement increases benefits through continued AWI growth. Retirement is voluntary, and continued work always increases the PRA balance.

Conversion to Custodial Accounts

At retirement—early, at age 68, or later—a worker’s notional PRA converts in full to a private custodial PRA account, becoming real financial property held outside the government bookkeeping system.

Retirement Payout Options

After conversion, retirees may choose systematic withdrawals, partial annuitization, or full annuitization. Annuitization is not mandatory. Minimum-income rules may be applied analytically for scoring. Unannuitized balances remain fully inheritable; annuitized residuals follow the rules specified in the Technical Specifications.

Ownership and Inheritance

PRA balances are owned property. If a worker dies before or during retirement, any unannuitized balance passes to the estate. Nothing is forfeited.

Tax Treatment

During the notional phase, PRA credits are treated as deferred retirement entitlements. Upon conversion, custodial PRAs follow IRA-style tax treatment: contributions and earnings are tax-deferred and withdrawals are taxable under standard retirement rules, consistent with conservative scoring.

How FICA Evolves

FICA remains unchanged initially to fund legacy obligations. Workers under age 55 continue to pay FICA during the transition, but those payments finance only legacy beneficiaries and generate no additional legacy accruals. As legacy outlays decline, remaining FICA collections are reclassified as PRA contributions.

When approximately 95 percent of remaining beneficiaries are PRA retirees and the legacy system has contracted to a small, predictable residual, the reduced FICA stream is redirected into private custodial PRAs. The payroll mechanism remains unchanged; only the destination changes. The default mandatory PRA contribution is about 3 percent of earnings, capped at median wages. Workers may voluntarily contribute more, and employers may offer matching contributions.

End State

As PRA contributions replace FICA, required saving is far lower than today’s payroll tax, raising take-home pay—especially for earnings above the median, which are no longer subject to a replacement tax. Because custodial PRAs earn full market returns, retirement benefits are projected to be much more than what Social Security is obligated to pay. As legacy beneficiaries pass away and PRA retirees complete their payout periods, government retirement obligations disappear. The pay-as-you-go system ends by being fully and permanently replaced by owned retirement property.

All technical assumptions, scoring parameters, and transition rules are governed by the Technical Specifications for Scoring.

Chart: © 2025 PRAUSA

Summary of What the PRA Plan Achieves

• Replaces the OASI portion of Social Security with individually owned Personal Retirement Accounts

• Automatic enrollment for all workers under age 55

• Full protection for current retirees and near-retirees

• Closure of the legacy system to new benefit accruals

• Resolution of the projected OASI shortfall through orderly contraction

• PRA credits based on the familiar 35-year, wage-indexed framework

• Replacement rates increased by 10 percent relative to current law

• AWI indexing for long-run solvency and wage alignment

• Statutory retirement age of 68 with flexible early or delayed retirement

• Full conversion of notional PRAs to private custodial accounts at retirement

• Multiple payout options after conversion, including withdrawals and annuitization

• Fully inheritable retirement property with no forfeiture at death

• IRA-style tax treatment for custodial PRAs, consistent with conservative scoring

• Gradual transition from payroll taxes to private saving through FICA redirection

• Default mandatory PRA contribution of about 3 percent of earnings

• Mandatory contributions capped at median wages, not today’s $184,500 OASI cap

• Workers earning above the median face no replacement tax as FICA phases out

• Effective wage increase of 10.6 percent on earnings above the median

• Projected retirement wealth several times greater than Social Security is obligated to pay

• Rising take-home pay, stronger work incentives, and higher national saving

• A permanent shift from intergenerational transfers to funded, owned retirement assets

Social Security was built for a world that no longer exists. The PRA Plan replaces it in an orderly, transparent way that protects older Americans, empowers workers, strengthens families through inheritance, and restores long-run retirement solvency through ownership.

CALL TO ACTION

America will only secure real retirement freedom if millions of citizens demand it. Sign up to help push Congress toward action—and make this change a national priority.

© Copyright 2025, PRAUSA. All Rights Reserved. Content may not be reproduced without permission.