Technical Specifications for Scoring

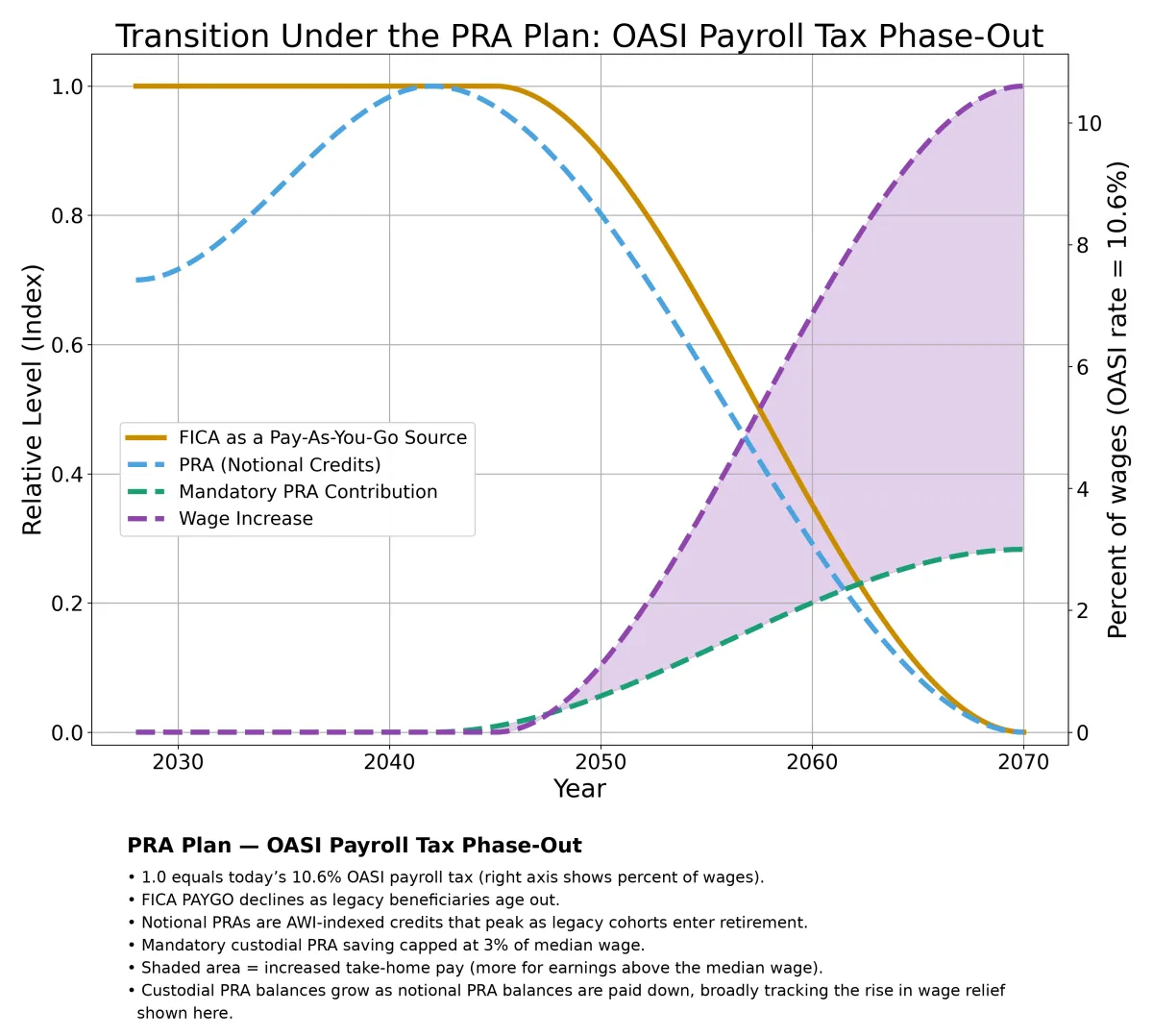

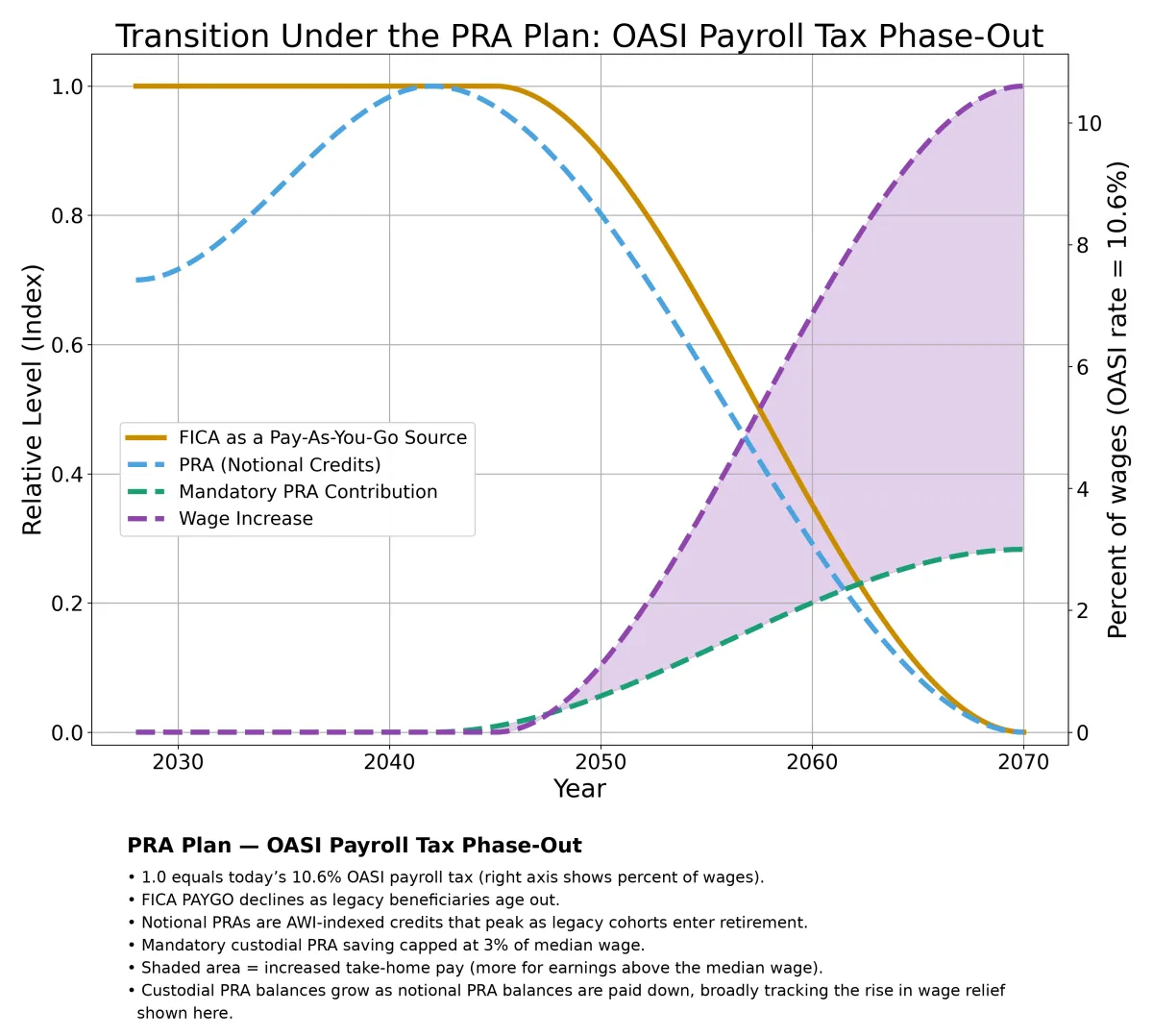

The PRA Plan replaces Social Security with individually owned, inheritable accounts that grow with wages. Workers under 55 receive retroactive credits and build PRA balances that yield higher benefits and greater flexibility than today’s system. As legacy retirees decline, FICA gradually converts into lower mandatory PRA contributions, ultimately creating a fully private, property-based retirement system with rising take-home pay.

Technical Specifications for Scoring

All technical assumptions, scoring parameters, and transition rules governing the PRAUSA plan are defined exclusively by this Technical Specifications for Scoring (TSS) document. No provision of The Plan may be interpreted, modeled, or scored independently of these specifications.

This document applies only to the Old-Age and Survivors Insurance (OASI) program. Disability Insurance (DI) and Medicare are excluded.

I. System Architecture and Scope

The PRAUSA plan transitions OASI from a pay-as-you-go transfer system to a fully funded system of individually owned Personal Retirement Accounts (PRAs) through a sunset-and-shift process. The legacy OASI system is closed to new defined-benefit accruals for younger cohorts, placed into controlled runoff, and fully liquidated over time.

No Recognition Bonds, transition bonds, or other newly issued federal debt instruments are authorized or permitted.

II. Cohort Treatment and Closure of the Legacy System

Legacy Cohorts

All workers aged 55 and older at implementation remain within the legacy OASI system and continue to accrue defined-benefit obligations under current-law formulas until retirement, subject to the adjustments defined in this document.

Transition Cohorts

Workers under age 55 cease accruing new OASI defined-benefit obligations as of implementation. Benefits accrued to date are converted into Notional Credits recorded on SSA-maintained bookkeeping accounts.

Closure Rule

After implementation, no new defined-benefit obligations are accrued for the under-55 cohort. Legacy OASI is thereby converted into a closed-group runoff system with declining liabilities.

Unfunded Obligation Treatment

Ending new legacy benefit accruals for workers under age 55 immediately closes the open-ended pipeline that drives most of Social Security’s projected unfunded obligations. The commonly cited 75-year unfunded-obligation estimate reflects the present value of future benefit obligations, the majority of which correspond to benefits that have not yet been earned. By halting further accruals under the legacy OASI formula for younger workers at implementation, the Plan eliminates the creation of those projected obligations at inception. On a forward-looking basis, this extinguishes roughly two-thirds of the projected 75-year unfunded obligations—on the order of $44–$51 trillion out of an estimated $68 trillion—while converting the remainder into a finite, declining obligation associated with current retirees and near-retirees. That remaining obligation is serviced over time through existing payroll tax flows and is not replaced as cohorts age out.

III. Notional Credits (Bookkeeping PRAs)

Definition

Notional Credits represent a worker’s accrued legacy benefit obligation expressed as a dollar-denominated bookkeeping balance.

Indexing

Notional Credits are indexed annually to the Average Wage Index (AWI). The indexing rate is fixed by statute and may not exceed AWI.

Legal Status

Notional Credits are bookkeeping records, not marketable assets, not debt instruments, and do not require advance cash funding.

IV. Adjustments to Legacy Benefits

Retirement Age Adjustment

The Normal Retirement Age for legacy OASI benefits is increased to 68, phased in by birth cohort. The phase-in schedule shall be specified in statute and applied uniformly by birth cohort.

Other Adjustments

No additional benefit adjustments are assumed for scoring purposes unless explicitly enacted in statute. Absent such enactment, no modification to COLA methodology, benefit formulas, or longevity indexing may be assumed, imputed, or inferred by scoring agencies. Any enacted adjustment becomes mandatory and is incorporated directly into scoring.

V. Trust Fund Treatment and Legacy Payments

Trust Fund Role

The OASI Trust Fund functions solely as a liquidity reserve. It is not a measure of solvency, and its drawdown is expected and intentional.

Trust Fund Exhaustion

Trust Fund exhaustion is defined as the point at which the statutory OASI Trust Fund balance reaches zero under cash accounting. Exhaustion does not constitute insolvency. Upon exhaustion, legacy benefit payments continue without interruption.

Legacy Payment Guarantee

All remaining legacy benefits are classified as mandatory federal spending backed by permanent appropriation from general revenues. Trust fund exhaustion is not a failure condition for scoring.

VI. Cash-Flow-Permit Trigger for PRA Funding

Payroll tax diversion to funded PRAs is permitted only when legacy-system cash flow allows.

Trigger Condition

Annual PRA funding is permitted only when net cash flow equals or exceeds five percent (5%) of projected annual legacy OASI outlays.

Net cash flow is defined as OASI income (payroll tax receipts plus dedicated interest) minus legacy benefit outlays and minus SSA administrative costs related to OASI and notional bookkeeping.

Measurement Standard

The surplus condition must be satisfied using a rolling 12-month trailing average for two consecutive years.

Diversion Rule

Only the surplus amount may be diverted, subject to statutory annual caps and phased step-up schedules.

Automatic Suspension

If net cash flow falls below the required buffer, PRA funding is automatically reduced or suspended. Borrowing to sustain PRA contributions is prohibited.

VII. Fully Funded PRAs (Custodial Accounts)

Administration

Funded Personal Retirement Accounts are privately managed accounts held at qualified private custodians. Assets are owned by individual participants. The Social Security Administration does not hold PRA assets, manage investments, or maintain individual funded accounts.

Contribution Routing

During the transition period, when PRA funding is first initiated, the Social Security Administration may route permitted payroll contributions to designated private custodians. Once PRA funding is fully operational, payroll contributions are remitted directly by employers to participant-designated custodians through standard payroll deduction mechanisms. SSA routing authority is transitional only and sunsets automatically upon implementation of direct employer routing.

SSA Role

The Social Security Administration’s responsibilities are limited to maintaining the notional ledger, determining eligibility, and facilitating the transition to direct employer contribution routing. SSA has no ongoing role in asset custody or investment management.

Administrative Cost Cap

Administrative costs incurred by SSA in connection with OASI transition functions and notional bookkeeping are capped by statute and scored separately.

VIII. Retirement Income During the Transition

No individual reaching PRA eligibility may receive zero retirement income.

For cohorts reaching PRA eligibility before full PRA cash-flow maturity, retirement income is provided according to the following priority rules:

If legacy-system cash flow permits, retirement income is paid from legacy benefits derived from Notional Credits.

If legacy-system cash flow does not permit, retirement income is provided solely through annuity payments derived from available funded PRA Notional balances.

Deferred PRA balances continue to accrue investment returns and are annuitized or paid out only when legacy-system cash flow permits.

At no time are benefits paid through borrowing.

IX. Safety Valves and Enforcement Mechanisms

Debt Neutrality and Debt Reduction

No provision of this plan may increase federal debt. Any mechanism that would require new federal borrowing is automatically suspended. By closing OASI to new defined-benefit accruals and placing legacy obligations into a finite runoff, the plan converts an open-ended, implicit unfunded obligations into a declining, extinguishing obligation. Over time, this permanently eliminates the principal source of federal actuarial imbalance, resulting in a substantial reduction in the government’s implicit debt burden relative to current law.

Liquidity Enforcement

If liquidity constraints arise, PRA funding or distributions adjust automatically; legacy benefit payments are governed by the priority rules defined in this document.

Automatic Stabilization

Economic downturns slow the transition. Economic expansions accelerate it.

X. Scoring Instructions

The plan is scored on a unified federal budget basis.

Legacy OASI is scored as a closed-group obligation with a declining obligation path. Once legacy obligations are extinguished, OASI payroll taxes are eliminated. The Social Security Administration continues to administer Disability Insurance and Medicare coordination functions.

XI. Final Condition

If any provision of this plan requires new federal borrowing, that provision is null and void. The PRAUSA plan relies solely on time, demographics, and enacted adjustments.

Scoring Logic Summary (For OCACT)

Purpose

This plan converts OASI into a closed-group legacy system while transitioning younger workers to fully funded retirement accounts without issuing new federal debt.

Legacy System Treatment

OASI is closed to new defined-benefit accruals for workers under age 55 at implementation. Workers aged 55 and older continue accruing legacy benefits until retirement under current law, subject to enacted adjustments. Legacy benefits are paid as mandatory spending. Trust fund exhaustion is a planned liquidity event, not insolvency.

Notional Credits

Accrued legacy benefits for workers under age 55 are recorded as AWI-indexed notional balances. These balances are bookkeeping records, not debt instruments, and require no prefunding.

Cash-Flow-Permit Mechanism

Payroll tax diversion to funded PRAs occurs only when OASI cash flow exceeds legacy obligations and administrative costs by at least five percent of annual outlays for two consecutive years. This eliminates the double-payment problem and prevents deficit creation.

Retirement Income Continuity

All retirees receive income. Early PRA cohorts receive either legacy-based payments when cash flow permits or annuity income derived from funded PRA balances when it does not. Deferred balances are annuitized later as liquidity allows.

Debt Neutrality

No borrowing is authorized at any stage. PRA funding, timing, and distributions adjust automatically to cash availability.

Long-Run Outcome

Legacy obligations decline continuously and extinguish. OASI payroll taxes end. Retirement provision becomes fully funded, owned, and inheritable.

CALL TO ACTION

America will only secure real retirement freedom if millions of citizens demand it. Sign up to help push Congress toward action—and make this change a national priority.

© Copyright 2025. PRAUSA. All Rights Reserved. Content may not be reproduced without permission.

Technical Specifications for Scoring

The PRA Plan replaces Social Security with individually owned, inheritable accounts that grow with wages. Workers under 55 receive retroactive credits and build PRA balances that yield higher benefits and greater flexibility than today’s system. As legacy retirees decline, FICA gradually converts into lower mandatory PRA contributions, ultimately creating a fully private, property-based retirement system with rising take-home pay.

Technical Specifications for Scoring

All technical assumptions, scoring parameters, and transition rules governing the PRAUSA plan are defined exclusively by this Technical Specifications for Scoring (TSS) document. No provision of The Plan may be interpreted, modeled, or scored independently of these specifications.

This document applies only to the Old-Age and Survivors Insurance (OASI) program. Disability Insurance (DI) and Medicare are excluded.

I. System Architecture and Scope

The PRAUSA plan transitions OASI from a pay-as-you-go transfer system to a fully funded system of individually owned Personal Retirement Accounts (PRAs) through a sunset-and-shift process. The legacy OASI system is closed to new defined-benefit accruals for younger cohorts, placed into controlled runoff, and fully liquidated over time.

No Recognition Bonds, transition bonds, or other newly issued federal debt instruments are authorized or permitted.

II. Cohort Treatment and Closure of the Legacy System

Legacy Cohorts

All workers aged 55 and older at implementation remain within the legacy OASI system and continue to accrue defined-benefit obligations under current-law formulas until retirement, subject to the adjustments defined in this document.

Transition Cohorts

Workers under age 55 cease accruing new OASI defined-benefit obligations as of implementation. Benefits accrued to date are converted into Notional Credits recorded on SSA-maintained bookkeeping accounts.

Closure Rule

After implementation, no new defined-benefit obligations are accrued for the under-55 cohort. Legacy OASI is thereby converted into a closed-group runoff system with declining liabilities.

Unfunded Obligations Treatment

Ending new legacy benefit accruals for workers under age 55 immediately closes the open-ended pipeline that drives most of Social Security’s projected unfunded obligations. The commonly cited 75-year unfunded-obligation estimate reflects the present value of future benefit obligations, the majority of which correspond to benefits that have not yet been earned. By halting further accruals under the legacy OASI formula for younger workers at implementation, the Plan eliminates the creation of those projected obligations at inception. On a forward-looking basis, this extinguishes roughly two-thirds of the projected 75-year unfunded obligation—on the order of $44–$51 trillion out of an estimated $68 trillion—while converting the remainder into a finite, declining obligation associated with current retirees and near-retirees. That remaining obligation is serviced over time through existing payroll tax flows and is not replaced as cohorts age out.

III. Notional Credits (Bookkeeping PRAs)

Definition

Notional Credits represent a worker’s accrued legacy benefit obligation expressed as a dollar-denominated bookkeeping balance.

Indexing

Notional Credits are indexed annually to the Average Wage Index (AWI). The indexing rate is fixed by statute and may not exceed AWI.

Legal Status

Notional Credits are bookkeeping records, not marketable assets, not debt instruments, and do not require advance cash funding.

IV. Adjustments to Legacy Benefits

Retirement Age Adjustment

The Normal Retirement Age for legacy OASI benefits is increased to 68, phased in by birth cohort. The phase-in schedule shall be specified in statute and applied uniformly by birth cohort.

Other Adjustments

No additional benefit adjustments are assumed for scoring purposes unless explicitly enacted in statute. Absent such enactment, no modification to COLA methodology, benefit formulas, or longevity indexing may be assumed, imputed, or inferred by scoring agencies. Any enacted adjustment becomes mandatory and is incorporated directly into scoring.

V. Trust Fund Treatment and Legacy Payments

Trust Fund Role

The OASI Trust Fund functions solely as a liquidity reserve. It is not a measure of solvency, and its drawdown is expected and intentional.

Trust Fund Exhaustion

Trust Fund exhaustion is defined as the point at which the statutory OASI Trust Fund balance reaches zero under cash accounting. Exhaustion does not constitute insolvency. Upon exhaustion, legacy benefit payments continue without interruption.

Legacy Payment Guarantee

All remaining legacy benefits are classified as mandatory federal spending backed by permanent appropriation from general revenues. Trust fund exhaustion is not a failure condition for scoring.

VI. Cash-Flow-Permit Trigger for PRA Funding

Payroll tax diversion to funded PRAs is permitted only when legacy-system cash flow allows.

Trigger Condition

Annual PRA funding is permitted only when net cash flow equals or exceeds five percent (5%) of projected annual legacy OASI outlays.

Net cash flow is defined as OASI income (payroll tax receipts plus dedicated interest) minus legacy benefit outlays and minus SSA administrative costs related to OASI and notional bookkeeping.

Measurement Standard

The surplus condition must be satisfied using a rolling 12-month trailing average for two consecutive years.

Diversion Rule

Only the surplus amount may be diverted, subject to statutory annual caps and phased step-up schedules.

Automatic Suspension

If net cash flow falls below the required buffer, PRA funding is automatically reduced or suspended. Borrowing to sustain PRA contributions is prohibited.

VII. Fully Funded PRAs (Custodial Accounts)

Administration

Funded Personal Retirement Accounts are privately managed accounts held at qualified private custodians. Assets are owned by individual participants. The Social Security Administration does not hold PRA assets, manage investments, or maintain individual funded accounts.

Contribution Routing

During the transition period, when PRA funding is first initiated, the Social Security Administration may route permitted payroll contributions to designated private custodians. Once PRA funding is fully operational, payroll contributions are remitted directly by employers to participant-designated custodians through standard payroll deduction mechanisms. SSA routing authority is transitional only and sunsets automatically upon implementation of direct employer routing.

SSA Role

The Social Security Administration’s responsibilities are limited to maintaining the notional ledger, determining eligibility, and facilitating the transition to direct employer contribution routing. SSA has no ongoing role in asset custody or investment management.

Administrative Cost Cap

Administrative costs incurred by SSA in connection with OASI transition functions and notional bookkeeping are capped by statute and scored separately.

VIII. Retirement Income During the Transition

No individual reaching PRA eligibility may receive zero retirement income.

For cohorts reaching PRA eligibility before full PRA cash-flow maturity, retirement income is provided according to the following priority rules:

If legacy-system cash flow permits, retirement income is paid from legacy benefits derived from Notional Credits.

If legacy-system cash flow does not permit, retirement income is provided solely through annuity payments derived from available funded PRA Notional balances.

Deferred PRA balances continue to accrue investment returns and are annuitized or paid out only when legacy-system cash flow permits.

At no time are benefits paid through borrowing.

IX. Safety Valves and Enforcement Mechanisms

Debt Neutrality and Debt Reduction

No provision of this plan may increase federal debt. Any mechanism that would require new federal borrowing is automatically suspended. By closing OASI to new defined-benefit accruals and placing legacy obligations into a finite runoff, the plan converts an open-ended, implicit unfunded obligation into a declining, extinguishing obligation. Over time, this permanently eliminates the principal source of federal actuarial imbalance, resulting in a substantial reduction in the government’s implicit debt burden relative to current law.

Liquidity Enforcement

If liquidity constraints arise, PRA funding or distributions adjust automatically; legacy benefit payments are governed by the priority rules defined in this document.

Automatic Stabilization

Economic downturns slow the transition. Economic expansions accelerate it.

X. Scoring Instructions

The plan is scored on a unified federal budget basis.

Legacy OASI is scored as a closed-group obligation with a declining obligation path. Once legacy obligations are extinguished, OASI payroll taxes are eliminated. The Social Security Administration continues to administer Disability Insurance and Medicare coordination functions.

XI. Final Condition

If any provision of this plan requires new federal borrowing, that provision is null and void. The PRAUSA plan relies solely on time, demographics, and enacted adjustments.

Scoring Logic Summary (For OCACT)

Purpose

This plan converts OASI into a closed-group legacy system while transitioning younger workers to fully funded retirement accounts without issuing new federal debt.

Legacy System Treatment

OASI is closed to new defined-benefit accruals for workers under age 55 at implementation. Workers aged 55 and older continue accruing legacy benefits until retirement under current law, subject to enacted adjustments. Legacy benefits are paid as mandatory spending. Trust fund exhaustion is a planned liquidity event, not insolvency.

Notional Credits

Accrued legacy benefits for workers under age 55 are recorded as AWI-indexed notional balances. These balances are bookkeeping records, not debt instruments, and require no prefunding.

Cash-Flow-Permit Mechanism

Payroll tax diversion to funded PRAs occurs only when OASI cash flow exceeds legacy obligations and administrative costs by at least five percent of annual outlays for two consecutive years. This eliminates the double-payment problem and prevents deficit creation.

Retirement Income Continuity

All retirees receive income. Early PRA cohorts receive either legacy-based payments when cash flow permits or annuity income derived from funded PRA balances when it does not. Deferred balances are annuitized later as liquidity allows.

Debt Neutrality

No borrowing is authorized at any stage. PRA funding, timing, and distributions adjust automatically to cash availability.

Long-Run Outcome

Legacy obligations decline continuously and extinguish. OASI payroll taxes end. Retirement provision becomes fully funded, owned, and inheritable.

CALL TO ACTION

America will only secure real retirement freedom if millions of citizens demand it. Sign up to help push Congress toward action—and make this change a national priority.

© Copyright 2025, PRAUSA. All Rights Reserved. Content may not be reproduced without permission.